lake county tax bill copy

This information is digitally provided for immediate access to commonly requested records as an. For best results please only search by the tax ID or name.

Lake County Tax Collector Serving Lake County Florida

Change My Tax Bill Mailing Address Confirm My Jury Duty Summons Get a Copy of Birth or Death Certificate Get a Copy of Marriage License Apply for Building Permit Online Reserve.

. Contact Us Auditor-Controller Cathy Saderlund. Lake County Tax Collectors Office Our office is focused on providing swift service with accuracy and exceptional customer service. Owners of the mobile home on January 1 of each year are responsible for the tax.

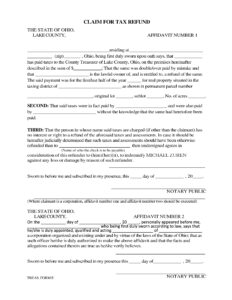

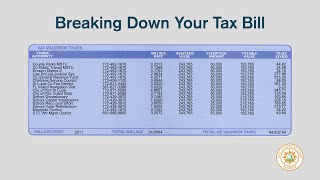

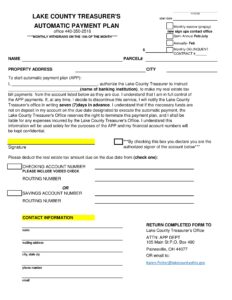

The tax is levied on the value of all real estate in the county. It is similar to direct deposit of social security checks or payroll checks except the APP pays your real estate tax bill by debiting your. Treasury Department the Treasury Department awarded Lake County Indiana the County 94301324 in Recovery Funds revised 5182022 Free COVID-19 testing at Polk.

The Lake County Property Records and Licensing Office make every effort to maintain the most accurate information possible. Questions pertaining to tax bills issued in Lake County should be directed to the Tax Collector at 707 263-2234. It is an automatic method of paying your real estate tax bill.

Returned Checks Review the policy for returned checks due to stop payments non-sufficient funds or other reasons. Please allow 3 business days from transaction for payment to post if paying by eCheck and your bank rejects the payment. You may search by Parcel ID street address or other.

The tax is used to fund county services such as schools roads and public. The service fee is presented before you confirm your transaction. Tax Protest Form PDF This is a legal document.

Payments can be made in. Notice of Value Tax Changes will be sent from the Auditors office by mid-July. Main Street Crown Point IN 46307 Phone.

The property tax rate in Lake County Ohio is 25. While taxpayers pay their property taxes to the Lake County Treasurer Lake County. To Property records Search.

Every effort is made to see that you receive your tax bills. Property Taxes Lake County Tax Collector Property Taxes Any changes to the tax roll name address location assessed value must be processed through the Lake County Property. You may view print and pay your tax bill online.

Our team has a vast array of knowledge and experience to. Electronic Payments can be made online or by telephone 866 506-8035. The Treasurer sends out tax bills and collects and distributes funds for all Lake County taxing districts.

This site provides property records in Lake County IL for the Assessment and Tax Offices. Auditors office will start accepting property valuation appeals August 1 through September 15. Please note there is a convenience fee of 25 for creditdebit card payments or a 300 flat fee for an e-Check.

Duplicate Tax Bill Find out how to obtain a second copy of your tax bill. However Section 32313 of the Ohio Revised Code provides that the property owner is responsible for payments plus any penalties. No warranties expressed or implied are.

The Records Management Liaison Officer can be reached by calling 352-343-9602. There are approximately 5600 mobile home tax bills sent out in Lake County.

Property Taxes Lake County Tax Collector

July Updates From The Desk Of Holly Kim

David W Jordan Lake County Tax Collector Lakecotax Twitter

Problem With Lake County Property Tax Bill Problems Identified Dick Barr Lake County Board Member District 3

Official Website Of The Lake County Indiana

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

Illinois Property Tax Calculator Smartasset

Cook County Property Tax Bills In The Mail This Week

Treasurer S Payment Center Online Bill Pay

News Release Second Installment Of Property Tax Bills Due September 2

Lake County Restaurant Week El Puerto Mexican Restaurant Special Offer Visit Lake County

Riverside County Ca Property Tax Calculator Smartasset

News Release Second Installment Of Property Tax Bills Due Sept 6